Proposal Title

A Proposal for Supercharging the Expansion of IOTA EVM Growth

- Yes - I support this Proposal

- No - I dont support this Proposal

Simple Summary

This proposal aims to boost the IOTA EVM ecosystem by leveraging the so-called unclaimed IOTA tokens, assets that were never migrated to the Chrysalis network, to provide necessary on-chain liquidity to boost the EVM ecosystem growth. Having deep liquidity in key trading pools makes our ecosystem much more attractive, enables seamless onboarding to IOTA, and fosters growth and stability in the IOTA EVM network.

Abstract

Effective liquidity management is crucial for the success of any decentralized finance (DeFi) ecosystem. This proposal addresses the initial lack of liquidity within the IOTA EVM network by utilizing unclaimed IOTA tokens—assets that were not migrated to the Crysalis network and have been mostly untouched since 2018.

We propose to transfer these tokens to a multi-signature wallet controlled by trusted members of the IOTA Ecosystem to allocate the funds to various DeFi initiatives to boost liquidity. This strategy aims to reduce high volatility and slippage in our DeFi ecosystem, improve trading efficiency, and enhance overall network performance and user adoption. Ultimately, this is a great way to boost IOTA EVM and its ecosystem and position it as one of the leading DeFi ecosystems in this space.

Motivation

IOTA EVM is the first big opportunity for IOTA to get its feet back on the ground in the Web3 space. We need to attract new users early in the EVM life cycle, and we need to attract developers who will build innovative and successful applications on our technology for a DeFi-hungry user base.

![]() Historically, our waiting for the emergence of “real-world use cases” outside of Web 3 has caused us to miss numerous opportunities within the Web3 space, specifically DeFi and its early beginnings. We cannot afford to continue this approach. Instead, we must prioritize the present realities by capturing user acquisition and retention opportunities, which are essential for a sustainable long-term strategy.

Historically, our waiting for the emergence of “real-world use cases” outside of Web 3 has caused us to miss numerous opportunities within the Web3 space, specifically DeFi and its early beginnings. We cannot afford to continue this approach. Instead, we must prioritize the present realities by capturing user acquisition and retention opportunities, which are essential for a sustainable long-term strategy.

![]() Liquidity is the most sought-after resource in this environment when paving the road to a successful DeFi ecosystem. Enough liquidity in an ecosystem is one of the main drivers for growth, as without it, nothing is achievable for teams building and investors seeking opportunities.

Liquidity is the most sought-after resource in this environment when paving the road to a successful DeFi ecosystem. Enough liquidity in an ecosystem is one of the main drivers for growth, as without it, nothing is achievable for teams building and investors seeking opportunities.

![]() Why liquidity matters, you may ask.

Why liquidity matters, you may ask. ![]()

![]() On-chain liquidity is vital for the success of decentralized finance (DeFi) ecosystems and the overall health of any blockchain network. It refers to the ease with which assets can be traded on the blockchain without causing significant price fluctuations. High liquidity ensures that transactions are executed swiftly, maintaining stable prices and reducing slippage, which is the difference between the expected price of a trade and the actual price.

On-chain liquidity is vital for the success of decentralized finance (DeFi) ecosystems and the overall health of any blockchain network. It refers to the ease with which assets can be traded on the blockchain without causing significant price fluctuations. High liquidity ensures that transactions are executed swiftly, maintaining stable prices and reducing slippage, which is the difference between the expected price of a trade and the actual price.

![]() Liquidity is the cornerstone and heartbeat of a DeFi ecosystem’s success. It allows users to have a better trading experience, unlock the potential of lending markets, and allows for on-chain leverage. The network effects of this would immensely impact our scalability and adoption rate. DeFi users prefer to operate on networks without worrying about high price impacts, slippage, or cascading liquidations. Sufficient liquidity helps with all of that.

Liquidity is the cornerstone and heartbeat of a DeFi ecosystem’s success. It allows users to have a better trading experience, unlock the potential of lending markets, and allows for on-chain leverage. The network effects of this would immensely impact our scalability and adoption rate. DeFi users prefer to operate on networks without worrying about high price impacts, slippage, or cascading liquidations. Sufficient liquidity helps with all of that.

Overall, liquidity ensures:

Market Stability: On-chain liquidity helps maintain stable market prices. When liquidity is high, assets can be bought or sold without causing large price swings, which is crucial for market stability.

Market Stability: On-chain liquidity helps maintain stable market prices. When liquidity is high, assets can be bought or sold without causing large price swings, which is crucial for market stability. Efficient Trading: High liquidity allows for quick and efficient trading. It ensures that buy and sell orders are filled promptly, making the market more attractive to traders and investors. This efficiency is particularly important in DeFi’s fast-paced world.

Efficient Trading: High liquidity allows for quick and efficient trading. It ensures that buy and sell orders are filled promptly, making the market more attractive to traders and investors. This efficiency is particularly important in DeFi’s fast-paced world. Reduced Slippage: In liquid markets, the risk of slippage is minimized. Slippage occurs when the price of an asset changes between the time a trade is initiated and when it is executed. Lower slippage means traders can execute large orders without significantly impacting the asset’s price.

Reduced Slippage: In liquid markets, the risk of slippage is minimized. Slippage occurs when the price of an asset changes between the time a trade is initiated and when it is executed. Lower slippage means traders can execute large orders without significantly impacting the asset’s price. DeFi dApp Functionality: Liquidity is the backbone of DeFi dApps, enabling, for example, decentralized exchanges (DEXs) and lending protocols to function effectively. Without sufficient liquidity, these platforms can’t secure smooth basic operations.

DeFi dApp Functionality: Liquidity is the backbone of DeFi dApps, enabling, for example, decentralized exchanges (DEXs) and lending protocols to function effectively. Without sufficient liquidity, these platforms can’t secure smooth basic operations.

IOTA EVM presents a significant opportunity for IOTA to re-establish itself in the market. However, the success of this endeavor critically depends on effective liquidity management. Without sufficient liquidity, decentralized finance (DeFi) ecosystems can face severe challenges, including high volatility, slippage, and inefficiencies, ultimately deterring users and hindering network growth.

![]() The past has shown that failures in managing liquidity effectively have led to significant challenges for several other chains. Here are a few examples that highlight the importance of robust liquidity strategies:

The past has shown that failures in managing liquidity effectively have led to significant challenges for several other chains. Here are a few examples that highlight the importance of robust liquidity strategies:

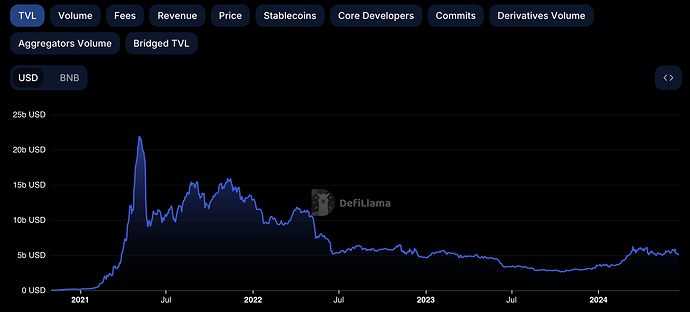

Binance Smart Chain (BSC):

While BSC has seen significant growth overall, it faced initial liquidity challenges that led to high volatility and slippage issues. The network’s reliance on a smaller number of liquidity providers initially created bottlenecks, resulting in sharp price fluctuations during high trading volumes. BSC’s adoption of the Proof of Staked Authority (PoSA) consensus mechanism helped mitigate some of these issues by reducing transaction costs and improving throughput, but the initial struggles underscored the critical need for adequate liquidity management.

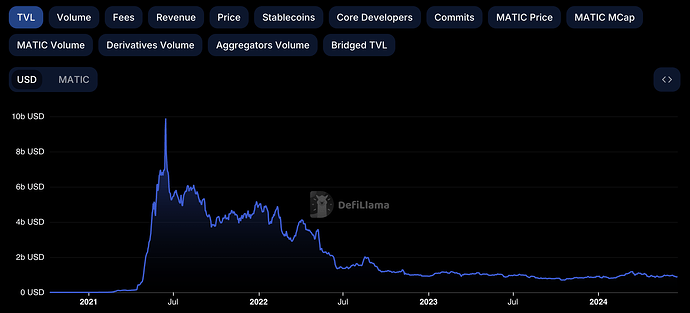

Polygon (MATIC): Polygon’s rapid expansion attracted numerous projects, but it encountered liquidity fragmentation across different pools and decentralized exchanges (DEXs). This fragmentation led to inefficiencies and higher transaction costs, which deterred users. Polygon has since worked on improving liquidity aggregation and incentivizing liquidity providers to stabilize the ecosystem. However, these initial challenges highlighted how poor liquidity strategies can hinder network performance and user adoption.

The Conclusion

![]() To successfully kickstart the IOTA EVM ecosystem and establish a robust foundation of circulating assets, we must focus on creating a highly attractive DeFi environment. This entails actively providing liquidity to ensure the IOTA EVM becomes a highly competitive network in our industry.

To successfully kickstart the IOTA EVM ecosystem and establish a robust foundation of circulating assets, we must focus on creating a highly attractive DeFi environment. This entails actively providing liquidity to ensure the IOTA EVM becomes a highly competitive network in our industry.

![]() To achieve this, sourcing liquidity is critical. One potential source of liquidity is the long-dormant and unused “unclaimed IOTA tokens.” These tokens can provide the necessary liquidity to support and grow our DeFi ecosystem on the IOTA EVM.

To achieve this, sourcing liquidity is critical. One potential source of liquidity is the long-dormant and unused “unclaimed IOTA tokens.” These tokens can provide the necessary liquidity to support and grow our DeFi ecosystem on the IOTA EVM.

The assets we aim to use:

The “unclaimed tokens” originate from the IOTA Legacy network, the first ever version of IOTA started in 2016.

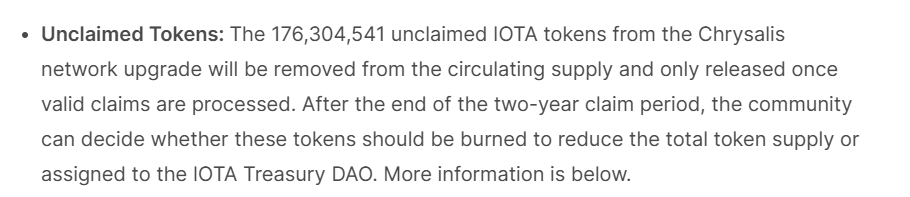

With the Chrysalis network upgrade in April 2021 the original IOTA Legacy network was shut down, and token holders needed to migrate their private keys to a new ledger with much-improved functionality. This was an easy step in IOTA’s Firefly wallet, available for all IOTA Token holders from 29 April 2021 to 3 October 2023.

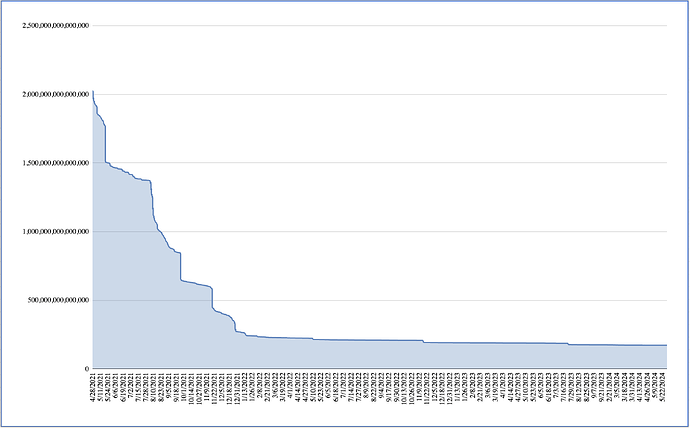

Shortly after the protocol upgrade on 29 April 2021, the “unclaimed Token Pool” consisted of 2.055 Billion IOTA (2,055,411,475,016,380i in the old denomination).

From this point until 3 October 2023, when the migration ability via Firefly ended, the unmigrated token pool was reduced to 175,89 million IOTA (175,893,692,656,111i in the old denomination). This means that only 8,55% of the initial unclaimed tokens were left over and remained unclaimed.

Following the “Stardust” network upgrade on October 3rd, 2023, we enabled token holders who had not yet migrated their tokens after the Chrysalis upgrade in April 2021 to continue claiming their assets in the new Stardust ledger via the “legacy migration claim tool” starting on 13 February 2024.

This legacy migration claim tool is a smart contract chain connected to the IOTA L1 that automatically distributes IOTA tokens to users that can prove ownership over a certain “unclaimed address” via the respective private key.

The Claim Tool has been initially funded with 5 million IOTA from the remaining 175,89 million unclaimed Tokens, and, since its existence, we see only very little activity (a couple of small addresses every few days), as can be seen here: Explorer Link Claim tool address.

This claim tool procedure has, since its introduction, further reduced the unclaimed token pool from 175,89 million IOTA to 172,96 million IOTA (172,959,958,839,825i in the old denomination). Now, as of last weeks data, 8,41% of the initial unclaimed Tokens, representing 3.82 % of the total IOTA supply, still remain unclaimed.

Balance “unclaimed tokens” from April 2021 to May 2024 (in the old denomination)

Furthermore, we investigated if we could identify a pattern or certain characteristics of the addresses contained in these 8,41% still unclaimed tokens. We have specifically looked for the largest holdings addresses in this pool and identified when they last became active in the IOTA legacy network.

Results - Top 15 “unclaimed addresses”: (Address, holdings in i (old denomination), last activity date)

- FMSOHMNE9DIDEEZNZSYXKVFAMCKWDBIWGQOJCTGOCXVSEBRREDPDBKWONXPFZZVD9NTAFKYZWQJTDZXTZ, 35244137849434, Tuesday, February 27, 2018

- VUFYQGAYDZBKOSADHQQCWQCGNSITEMVKGBKHSUILSWYNNUURBFPZFISXDFOOWTFIACEYAHVSOJHPINZ99, 13430688960000, Tuesday, February 27, 2018

- AMDQRWG99YBYJWBCZOJCVTJBEBT9UVABRJGBNIHQNG9WHAFQ9NAWAXOQXOXCNMMYYVYYMQOKICZQYOQOZ, 10105500800000, Thursday, March 29, 2018

- SRPIKKWNGQFTWDNBUAZUIYGELPTHLBCSFXCIRYQJVH9PZEJGRUL9ALMGBCIHDNDMIEWHHWJZXNXEVZEPD, 8338593000000, Tuesday, February 27, 2018

- MMPYMAYGTUZKTADLNZCWJWLOKCSFBNWDFWRKTLSIJSGAUTUC9APHEXNLONYXDSJHKECU9YIYISELOHAEZ, 7500000000000, Tuesday, February 27, 2018

- JOLBNTUMUQPTQGUPLQRWUCU9HULTSTQXHNJJKAIMMDWSKRNVKCXP9ZBLVSIMOCKFXQXRZWLTCJWTAVZZD, 6392919651539, Thursday, March 29, 2018

- DVGFJXOUFAX9NZZK9RRBIUEOHEGMRXHUDWXUIYESTDZSZPSISLHLXC9TEOLYFFALX9FHLZXWCGFNSVHHD, 3107232145838, Thursday, March 29, 2018

- GLSRYDYFDBJURWKODNZPNSGX9CAUYUEJFAVOQRYNBSWJKHSTHSMZYYHBMDPA9WQJYTUNBYEAFG9MGPNJC, 2844000000000, Thursday, January 25, 2018

- IUADRHTHPBZGEGQCVGFQFAUCPOZXAQCSTZZOQMOVC99PEMMWXEOVAJOSUFPQLRJKEQPOOOMREUXBLECUC, 2779531000000, Tuesday, February 27, 2018

- JIYBQXFZSWALKBIFAROMTEOOFKGEJXNDMQEJONNVZTOLOF9EPLPC9UWVPZIATWUKOEYGYCGOZOVFNUSWC, 2779530000000, Tuesday, February 27, 2018

- KF9DEI9PQQZLQYMRHTYZXBATZUFAKVVYIRFTFTQFRVOOVAEHZPAUFSZBNRKPSHKEDRBYUOKHUNWNDPEWX, 1943961538000, Wednesday, January 24, 2018

- NQJXQLLPWOMNZLM9H9KKVMFRDPPDWHNMXMZANEGNGMCBVQWRPYVNCNLSNALRZNKURHCLDNVTJFERUPEOX, 1600000000000, Wednesday, December 20, 2017

- YGXXZCBLTMRATKF9C9WHULZKDZQJGVKAYVQJPSNBMHJRGVPRSJVYBHMWARYLTGECZJRMVWYJPCDMQHQTD, 1526598857574, Friday, September 20, 2019

- CZXWFVBPEXEMMDKQEO9QHYJMHWEIFZUCJAVQVNJQAPPJWLLYOEMBSBSTJEQPMNHGRUJMAXLYIJ9MEVOSC, 1389765500000, Thursday, June 14, 2018

- UDINWGPANHJ9NPR9EJZO9THOT99HCPKUUTAQ9QCERWDACTPREMCDJJJWAIJOELKX9XQADTFFSWBJAJXCY, 1385246789011, Tuesday, August 14, 2018

These 15 Addresses alone contain 100,36 million IOTA or 58% of the remaining unclaimed tokens.

We have identified that 14 of these 15 Addresses were part of the “IOTA Kerl / Curl” incident and the reclaim users needed. Owners of these addresses had to go through a reclaim process to receive the tokens using a new private key created with the new “Curl” signature scheme. The 14 addresses above have never been touched by the private keys after this claim process.

Give dormant tokens a new life.

![]() The above data strongly indicates the unlikeliness of these tokens being claimed in the future. Therefore, it is in the network’s and the ecosystem’s interest to use these tokens more effectively by growing IOTA and its ecosystem. By bringing these tokens back to life and using them in yield-generating and ecosystem-supporting activities, we can create the favorable conditions this market seeks to attract sustainable new capital and user activity. Most importantly, by using them for bootstrapping liquidity on IOTA EVM, we can repurpose these tokens to benefit IOTA and the entire ecosystem.

The above data strongly indicates the unlikeliness of these tokens being claimed in the future. Therefore, it is in the network’s and the ecosystem’s interest to use these tokens more effectively by growing IOTA and its ecosystem. By bringing these tokens back to life and using them in yield-generating and ecosystem-supporting activities, we can create the favorable conditions this market seeks to attract sustainable new capital and user activity. Most importantly, by using them for bootstrapping liquidity on IOTA EVM, we can repurpose these tokens to benefit IOTA and the entire ecosystem.

![]() All funds will be dedicated to providing on-chain liquidity, ensuring continuous accessibility, and not constituting final spending. In the rare event that claims are made for these tokens, they will still be honored once the right to claim has been verified. This guarantees that while the tokens enhance liquidity, they remain accessible and can be reclaimed when rightful ownership is confirmed.

All funds will be dedicated to providing on-chain liquidity, ensuring continuous accessibility, and not constituting final spending. In the rare event that claims are made for these tokens, they will still be honored once the right to claim has been verified. This guarantees that while the tokens enhance liquidity, they remain accessible and can be reclaimed when rightful ownership is confirmed.

Additionally, around 2 million IOTA tokens remain in the claim tool, which we believe will be sufficient to honor future claims. If these tokens are fully utilized, we are committed to replenishing the claim tool.

Specification

Through this governance vote, we propose that the IOTA token holders grant permission to the BVI entity “Rising Phoenix 2” to take ownership of the unclaimed tokens and transfer them into a multi-signature wallet controlled by trusted members of the IOTA Ecosystem. Approval is granted to allocate them to the initiatives described below (“IOTA EVM Liquidity Bootstrapping Program”) in a way that benefits the network and ecosystem the most.

IOTA EVM Liquidity Bootstrapping Program

IOTA EVM Liquidity Bootstrapping Program

IOTA EVM Liquidity Management - 172 Million IOTA

- These tokens will be used to bootstrap the IOTA EVM. They will be deployed across several protocols across core verticals, predominantly but not limited to

DEXs (decentralized exchanges), Lending Markets, and CDPs (Collateralized Debt Positions).- The funds will not be used to farm ecosystem projects; we want to facilitate project growth by giving them boosted liquidity, and they can use those farming incentives to increase market penetration.

- The yield generated will come from swap fees and interest, which will be organic based on network activity. We propose using these proceeds to further ecosystem development through incentive campaigns or supporting grants. The exact approach will be determined at a later date, as it depends on the market circumstances. We are, however, committing to keeping any yield generated either on-chain, through incentives, or through grants.

![]() Transparency:

Transparency:

All assets used in the program will be held and distributed from a MultiSig Wallet in the IOTA EVM and fully traceable on the chain. The community will receive monthly reports on distribution and the purpose of spending.

A bot will automatically post every transaction into the IOTA Discord server.

No activities or spending other than the purposes described here are permitted.

![]() MultiSig Setup:

MultiSig Setup:

The multi-signature Wallet controlling these tokens will be set as a 3-of-5 signers MultiSig consisting of 3 Signers from the Tangle Ecosystem Association or the IOTA Ecosystem DLT Foundation and 2 Signers from the Ecosystem / Community.

The IOTA Ecosystem team members on the multisig will regularly inform the entire multisig committee about the strategy and rationale for specific actions.

![]() Decision-making Process on activities of the program:

Decision-making Process on activities of the program:

Without assuming any liability, the IOTA Ecosystem team will lead and oversee this entire initiative and will be the proposer of new transactions and prepare the transactions in the multi-sig wallet for the other signers to approve.

The IOTA Ecosystem team and its representatives will perform due diligence and continuous risk assessment on the positions managed by this Liquidity Program.

Rationale

The proposed changes are motivated by the need to address the initial lack of liquidity within the IOTA EVM network. We can provide the necessary liquidity to support and grow our DeFi ecosystem by utilizing unclaimed IOTA tokens. This approach has been chosen because it leverages existing assets which are unlikely to be claimed in the future, thereby maximizing their utility for the benefit of the entire IOTA community.

Implementation

In case this proposal passes the requirements of the community-governance process (reaches 50 supportive votes in the governance forum phase 1 discussion, reaches 100 supportive votes in the governance forum phase 2 poll, reaches 5% quorum participation and simple majority of Yes votes in a network-wide token based vote on IOTA L1 facilitated in the IOTA Firefly and Bloom Wallet) and is therefore officially accepted by the IOTA token holders, the following will happen:

- The MultiSig setup on the IOTA EVM will be initiated. MultiSig signers will agree to a MultiSig agreement defining their tasks and responsibilities.

- The respective tokens will be transferred from the IOTA L1 address to this new MultiSig wallet on IOTA EVM.

- The IOTA Ecosystem Team and its representatives will provide liquidity amongst selected dApps and trading pairs.

- We will set up a reporting structure on the IOTA Discord server to ensure transparency around the initiatives, with regular reports and automated transaction posts.

By following these steps, we will ensure the successful implementation and management of the IOTA EVM Liquidity Bootstrapping Program